Clearing an objection to striking off

Accounting entities

Businesses

Corporate Service Providers (CSP)

Close business or deregister

12 December 2025

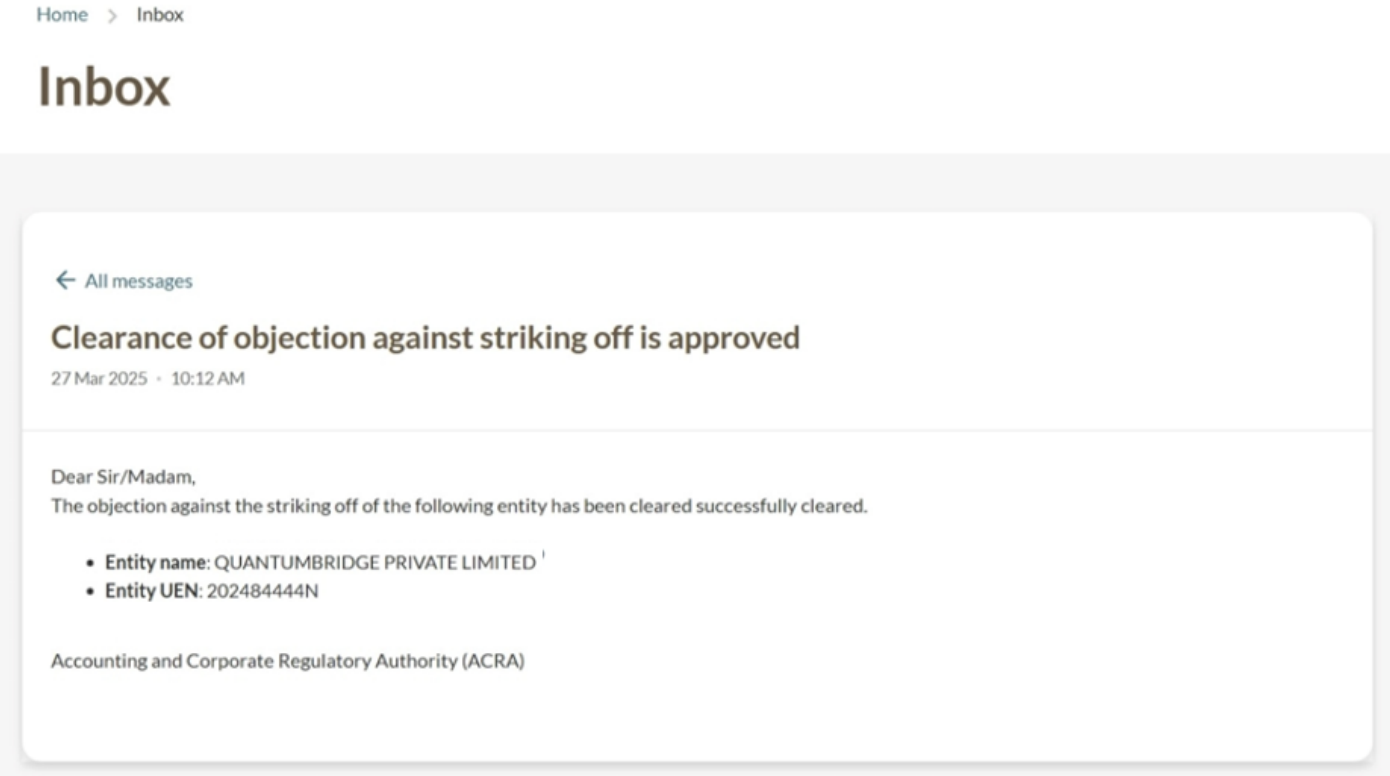

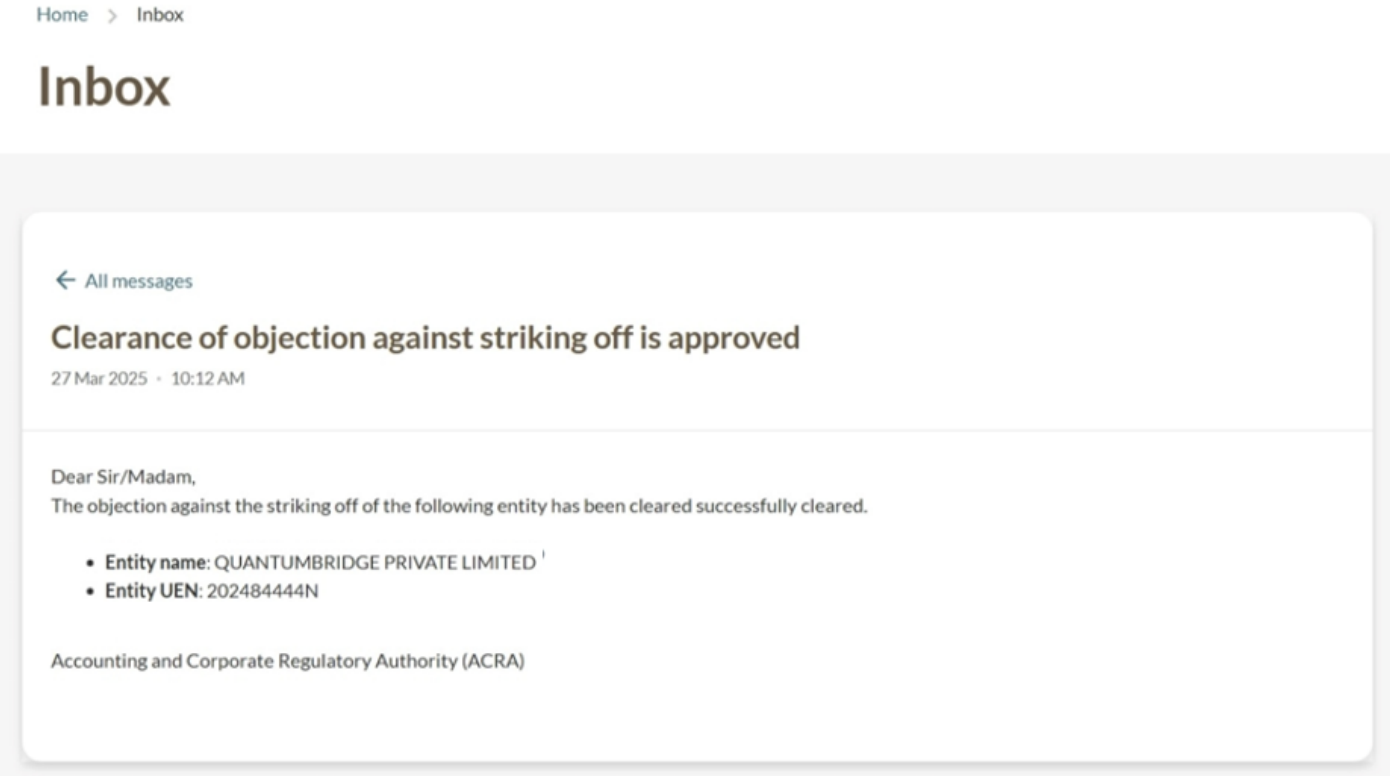

Objectors may clear an objection via Bizfile after all outstanding matters have been resolved.

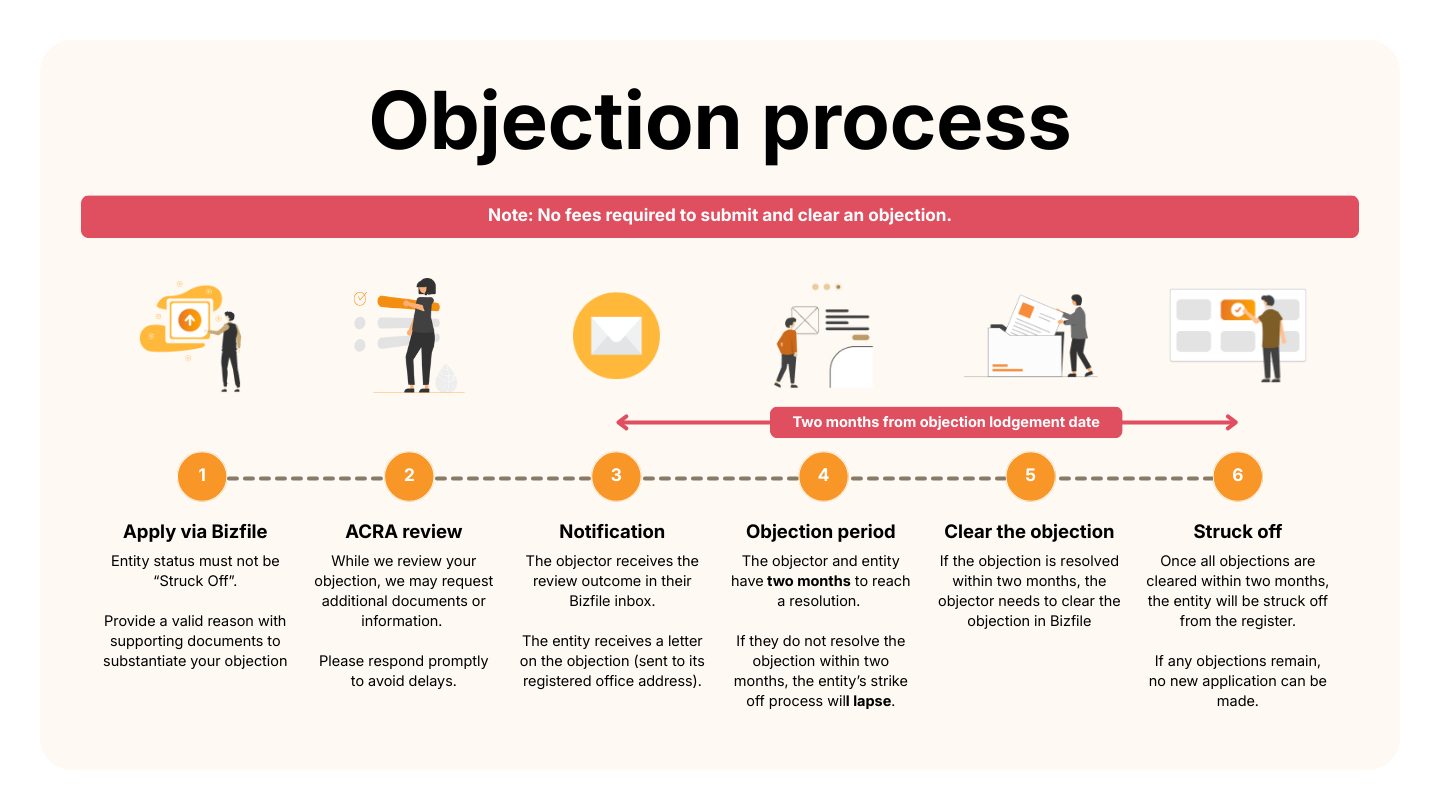

Overview of the objection process

Before you apply

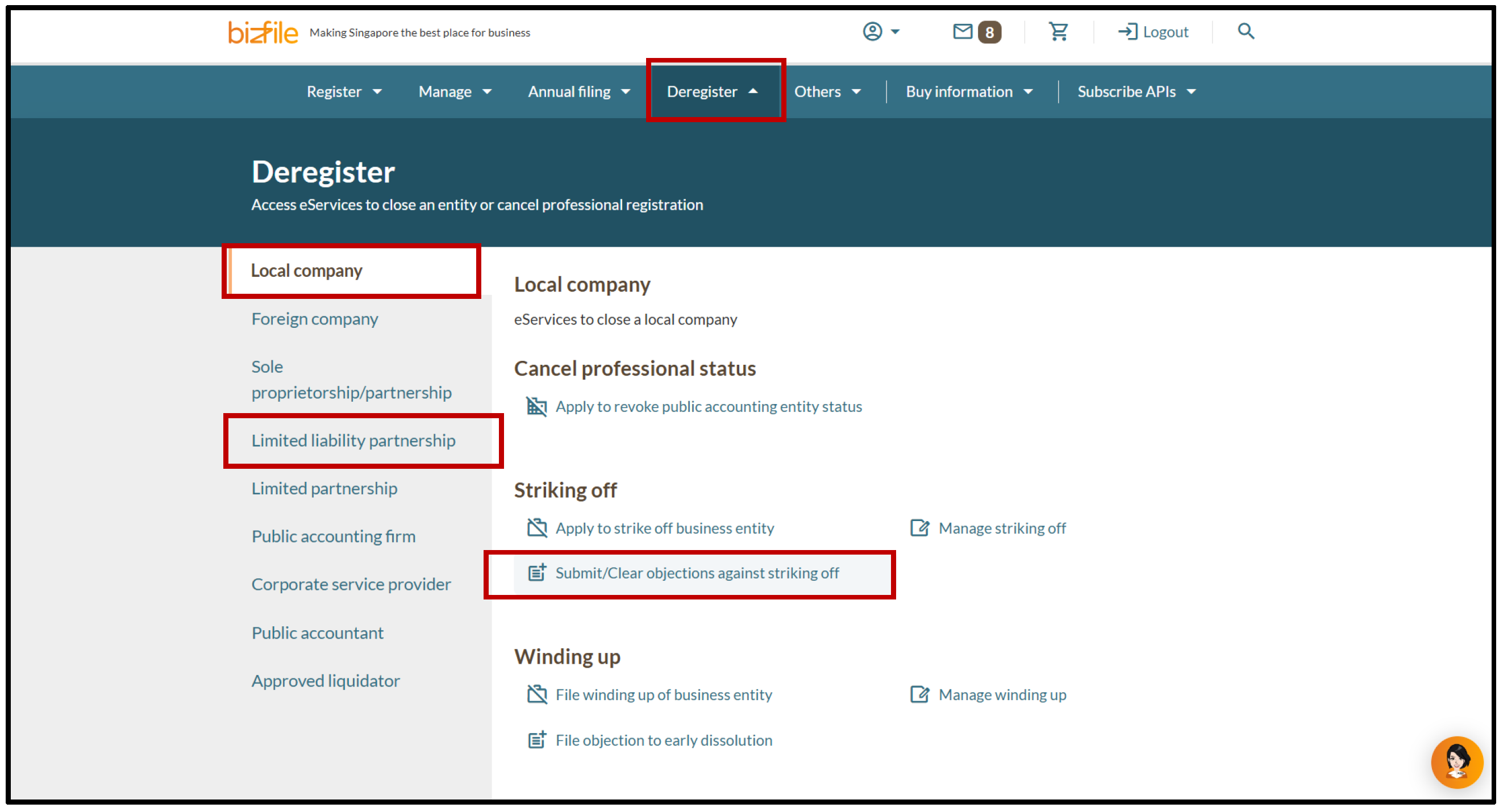

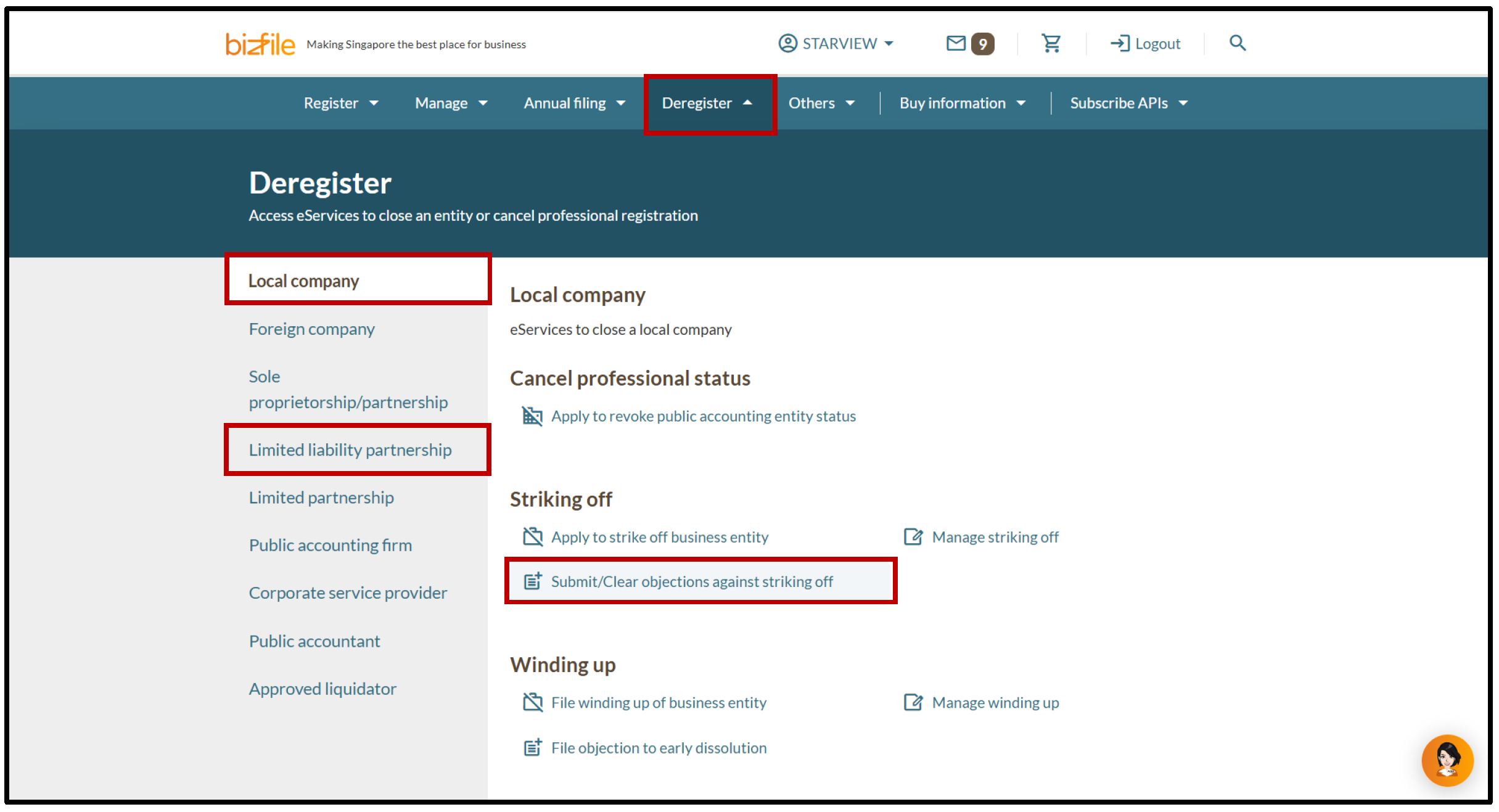

This guide explains how to clear an objection against striking off. Use the Submit/clear objections against striking off eService to clear an objection.

As an objector, you may clear an objection after:

ACRA approves your initial objection

Outstanding matters are resolved

Who may apply

Clearing an objection

For objections filed by | Who may apply |

|---|---|

| Only the person who filed the objection can clear it. |

| Any authorised Corppass user within the entity can clear the objection. |

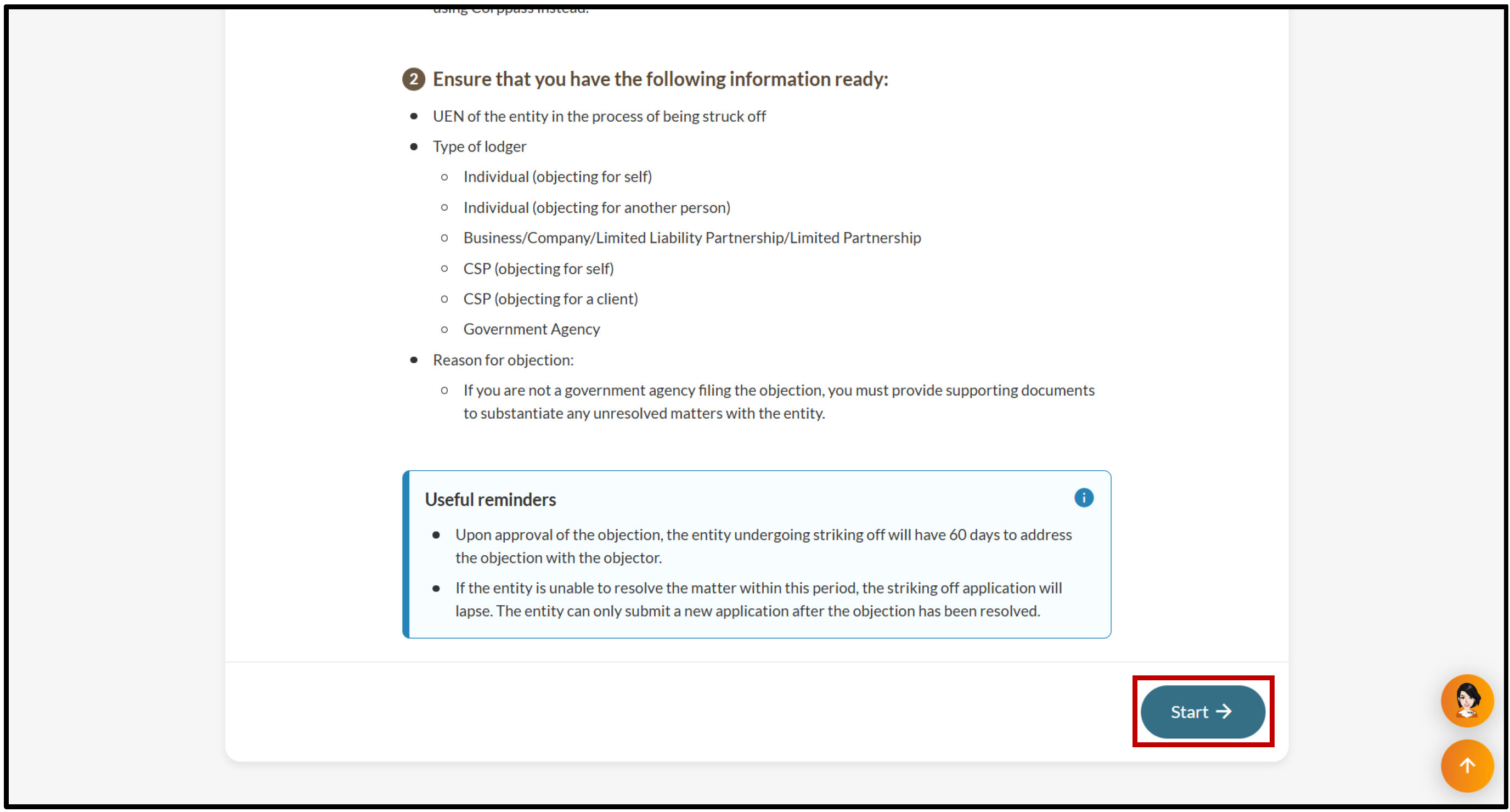

What you need to prepare

You need to prepare the unique entity number (UEN) of the entity you are clearing the objection against.

Fees and processing time

Clearing an objection

What you need to know | Details |

|---|---|

Fee | Free |

Approval time | Immediate |

Note: If objectors do not clear their objections within two months, the striking-off application will lapse.

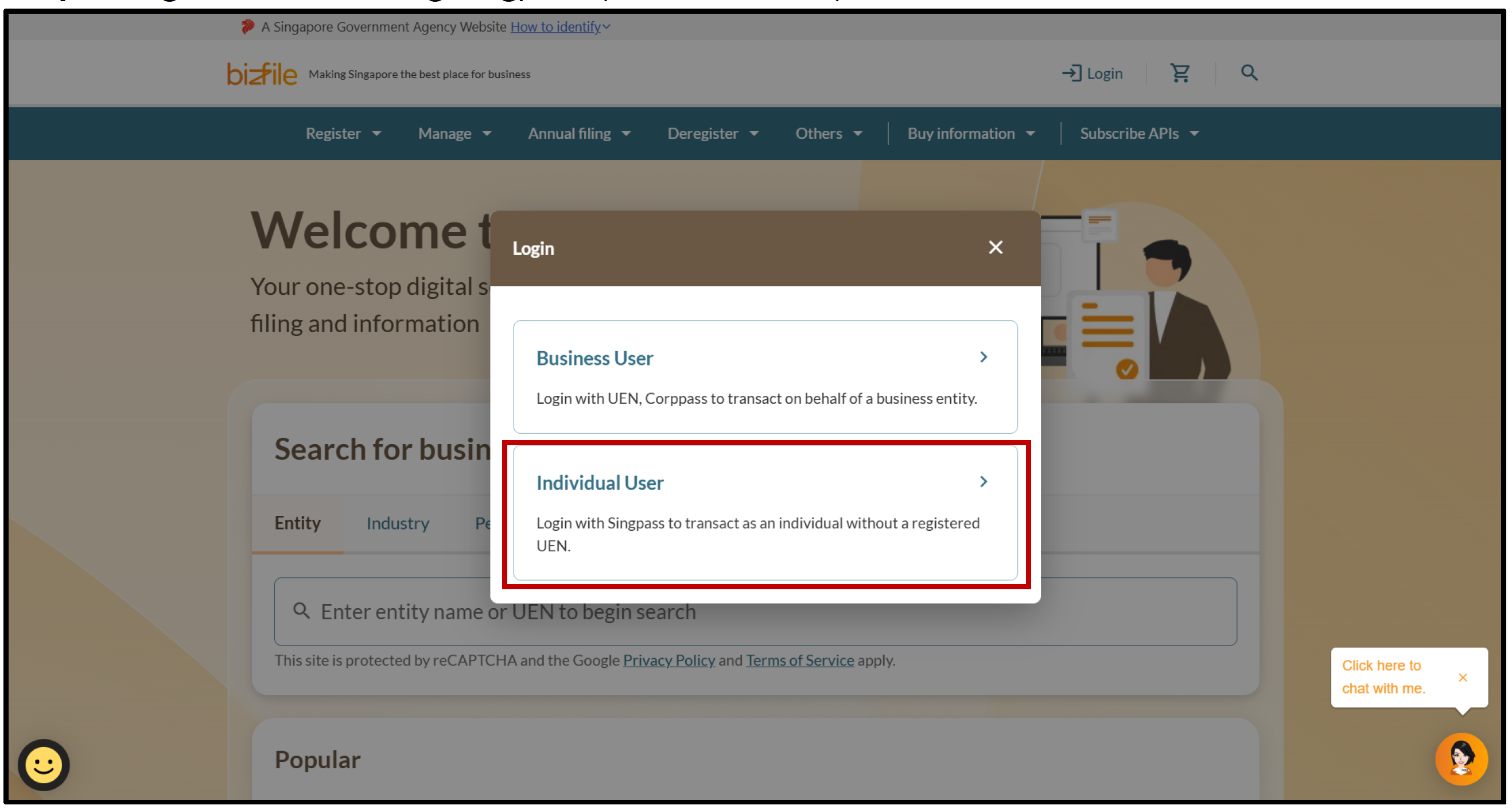

If you objected as an individual

Follow these steps to clear an objection for yourself or on behalf of another party.

All entity and personal information (including UEN, entity details, NRIC or FIN numbers, names and addresses) shown are dummy data for illustration purposes only.

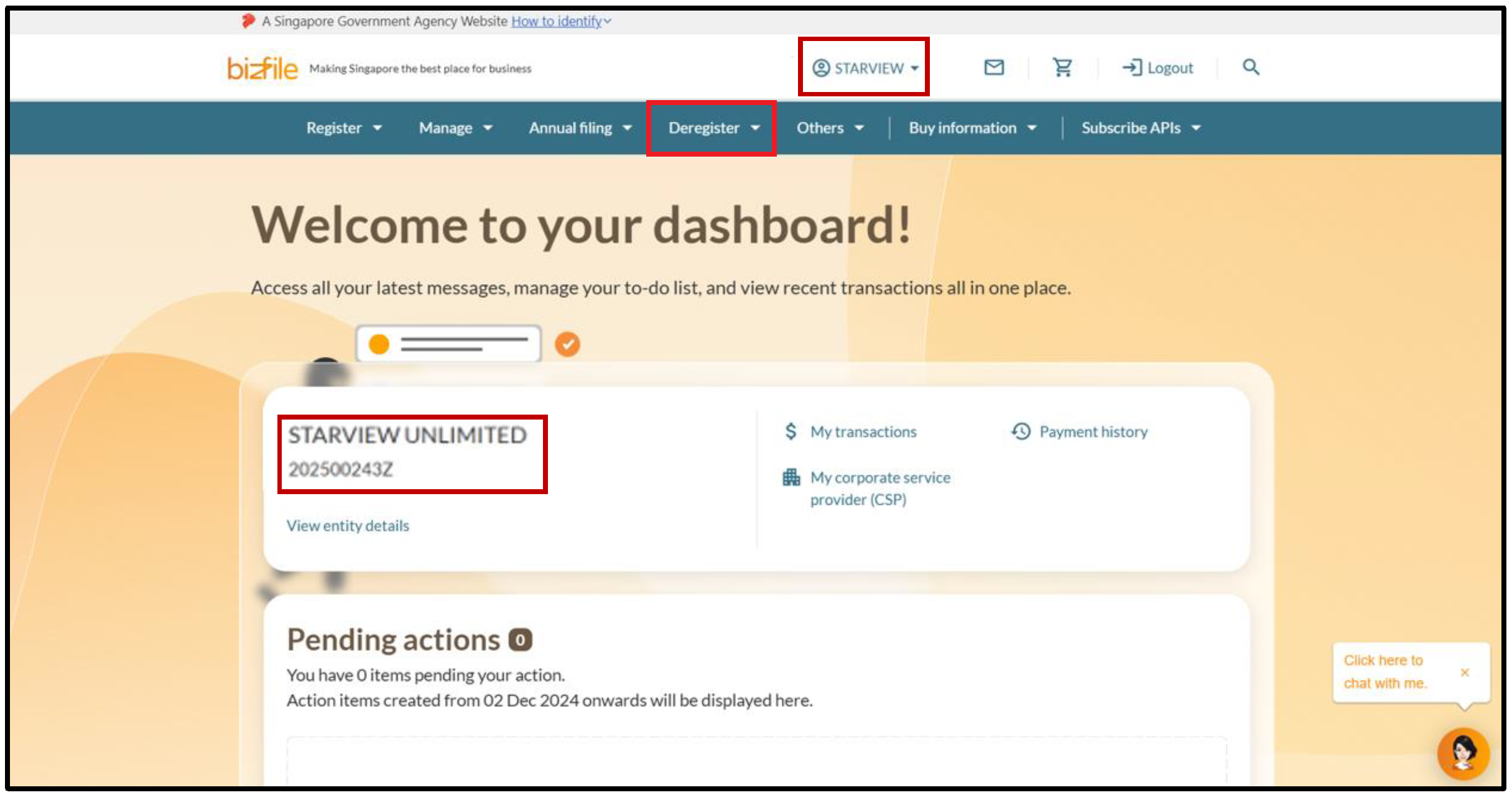

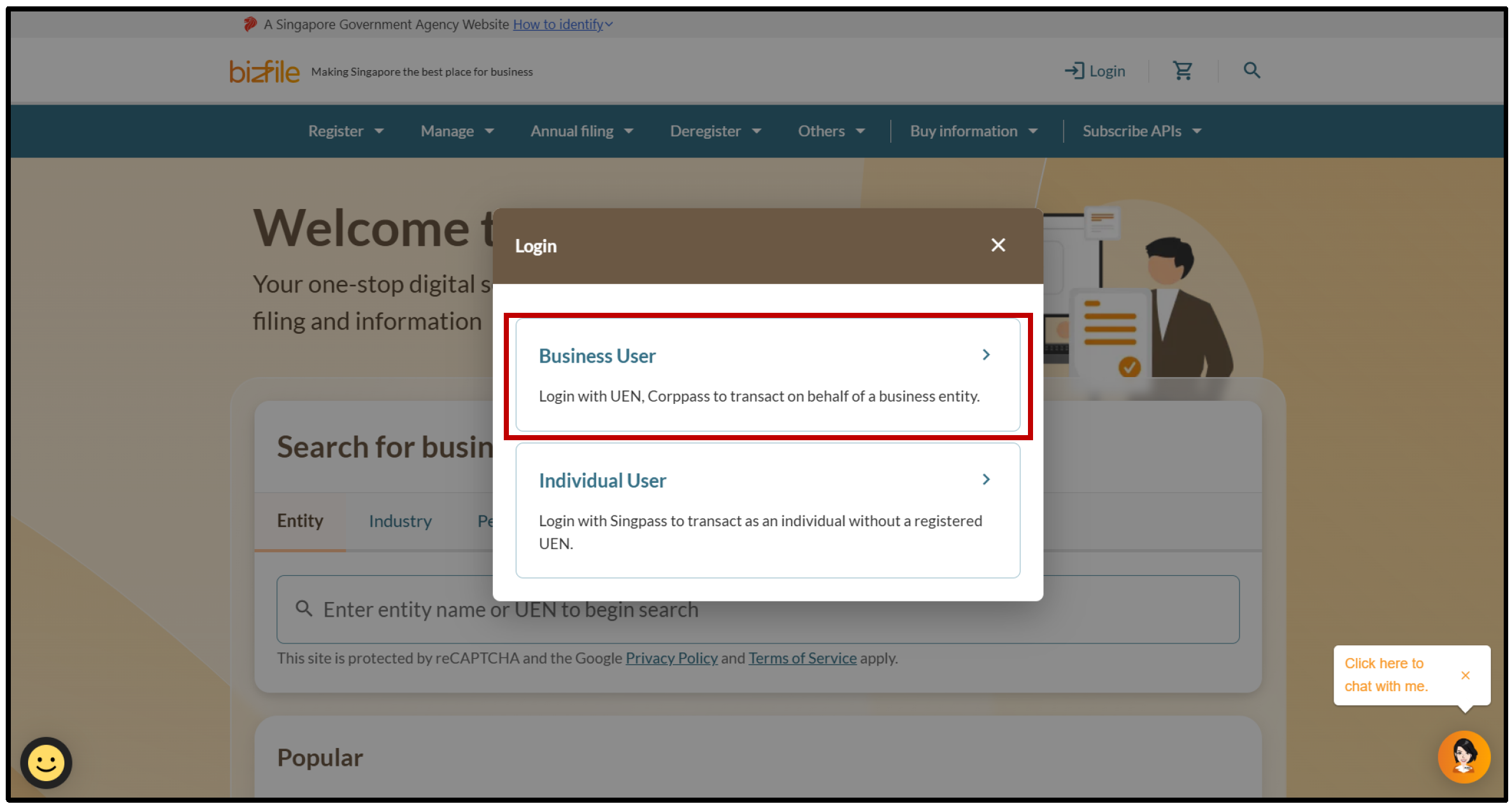

If you objected on behalf of an entity

Follow these steps to clear an objection on behalf of an entity.

All entity and personal information (including UEN, entity details, NRIC or FIN numbers, names and addresses) shown are dummy data for illustration purposes only.

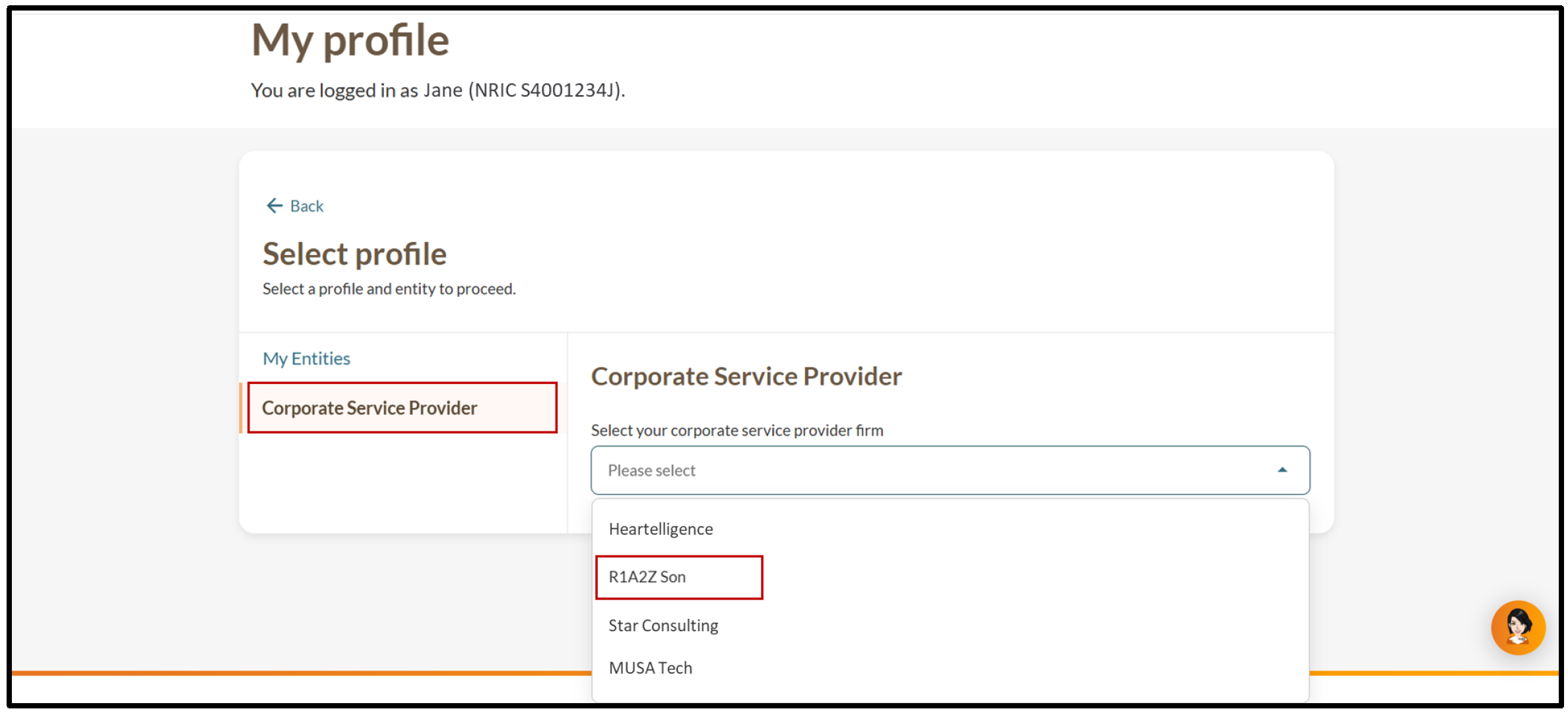

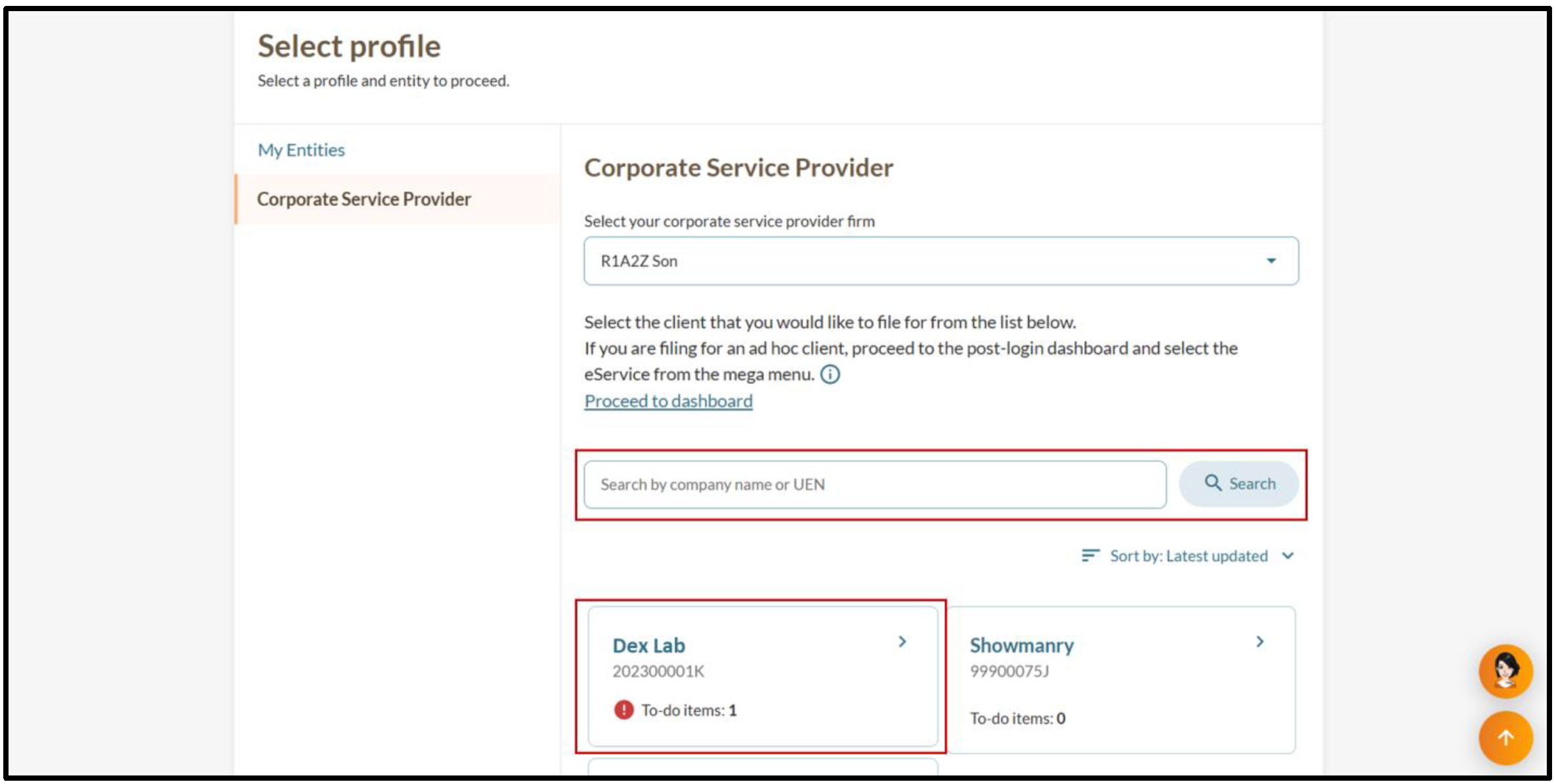

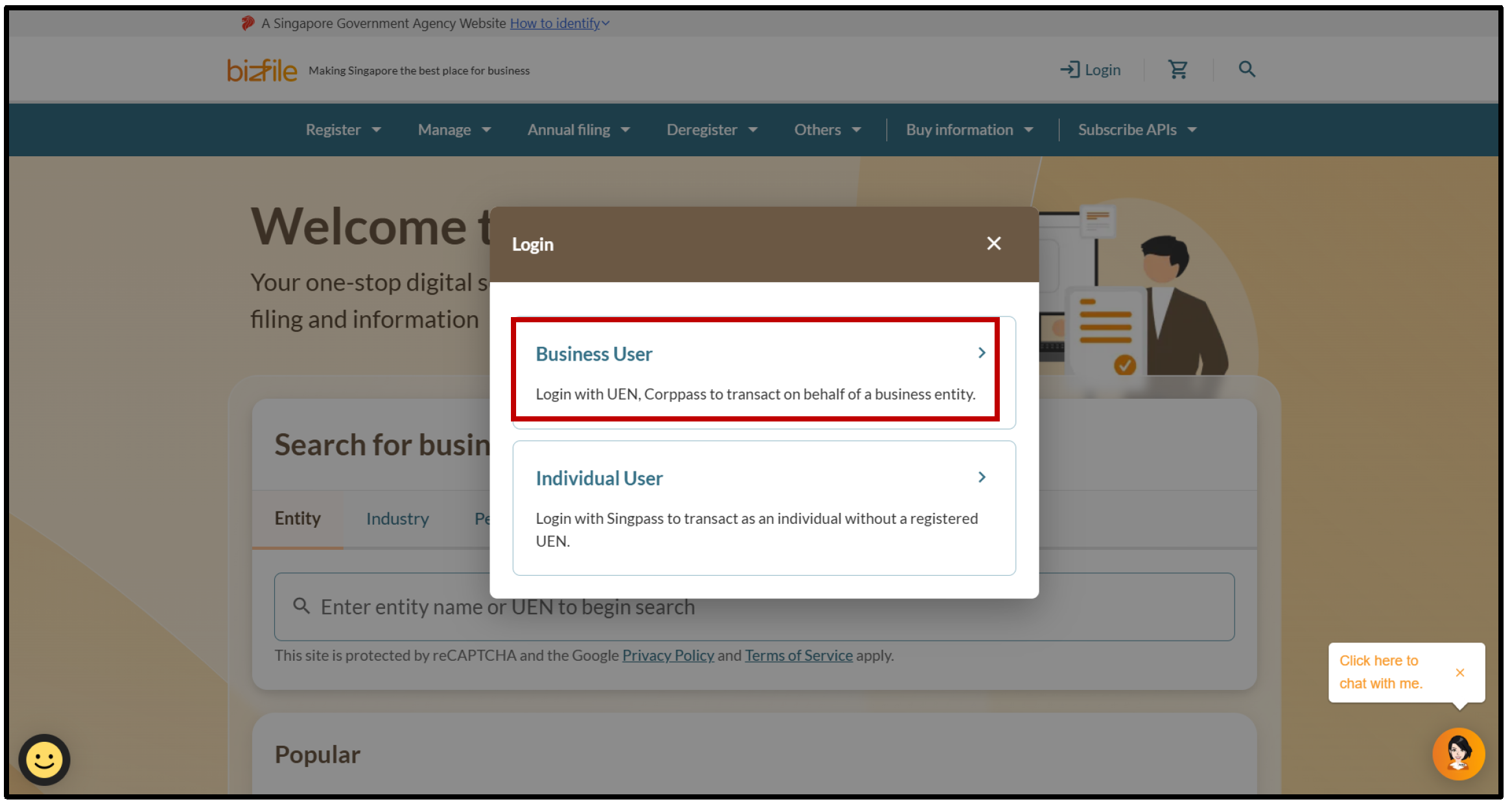

If you objected as a corporate service provider (CSP)

Follow these steps to clear an objection on behalf of your client or your own firm.

All entity and personal information (including UEN, entity details, NRIC or FIN numbers, names and addresses) shown are dummy data for illustration purposes only.