Nov/Dec 2025 Issue of ACRAConnect

Accountants

Accounting entities

Businesses

Corporate service providers (CSPs)

Public

Accountancy careers

Accounting standards and sector regulation

Corporate updates

Enforcement and penalties

Regulatory updates

9 January 2026

This article has been migrated from an earlier version of the site and may display formatting inconsistencies.

NOV / DEC 2026

Strengthening Industry Partnership through the CSP Advisory Panel

ACRA has set up a Corporate Service Providers Advisory Panel in November to strengthen our partnership with the CSP community. The 11-member panel, made up of stakeholders from the CSP sector, will focus on three areas over the next three years – regulatory compliance, professional competency and technology developments.

We thank the members for being a part of the Advisory Panel. Together, we can work towards strengthening our industry partnership in upholding Singapore's reputation as a trusted business hub.

Corporate Service Providers Advisory Panel (CAP)

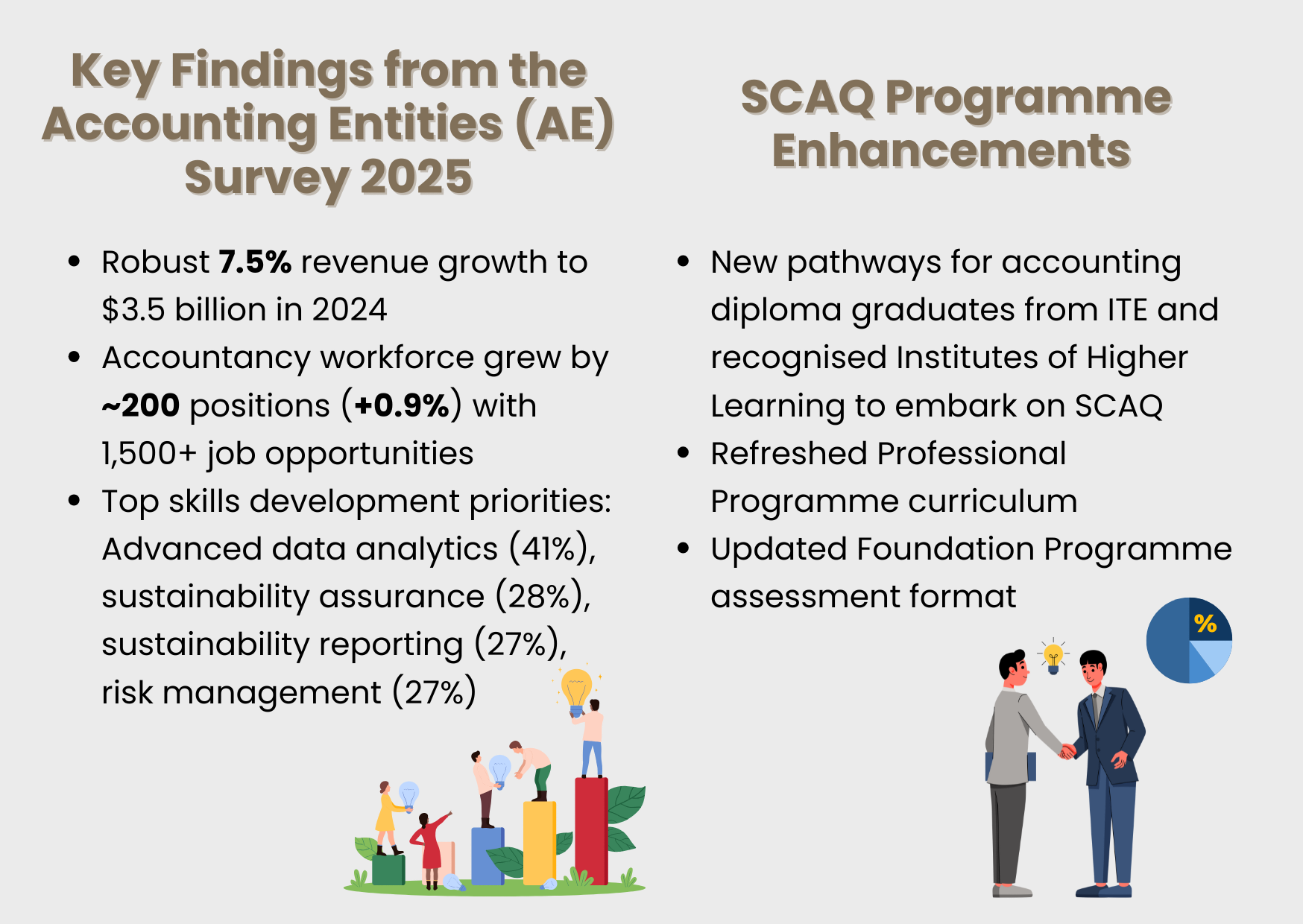

Key Findings from Accounting Entities Survey and Enhancements to the Singapore Chartered Accountant Qualification (SCAQ)

At the Institute of Singapore Chartered Accountants Conference 2025, in which ACRA was a supporting partner, Guest-of-Honour Ms Indranee Rajah, Minister in the Prime Minister's Office and Second Minister for Finance and National Development, unveiled key findings from ACRA's Accounting Entities (AE) Survey 2025, and announced enhancements to the Singapore Chartered Accountant Qualification (SCAQ).

These announcements mark important milestones in ACRA's efforts in building a sustainable pipeline of accountants.

Corporate and Accounting Laws (Amendment) Bill

Following the Ministry of Finance and ACRA's regular review of our corporate governance and regulatory framework, the Corporate and Accounting Laws (Amendment) Bill was passed in Parliament on 5 November 2025.

The amendments are a step forward in ensuring our regulatory framework evolves with business practices. They safeguard shareholders' interests, strengthen the regulatory framework for companies and enhance the regulatory regime for public accountants.

Read more about the Corporate and Accounting Laws (Amendment) Bill.

ACRA Takes Action Against Non-Compliance to the Companies Act

Three individuals were convicted and fined a total of $105,500 under the Companies Act 1967 for false declarations and failing to obtain proper consent documentation. They had faced 64 charges under the Companies Act and were registered qualified individuals when the offences were committed.

All three have been disqualified from acting as company directors for five years.

ACRA will take firm enforcement action against non-compliance, including suspending or cancelling registrations, and pursuing both corporate and individual accountability where appropriate. Under the Companies Act, false declarations can result in fines of up to $50,000 or imprisonment of up to two years, or both.

ACRA Strengthens Financial Reporting Standards with New Guidance

ACRA has issued Financial Reporting Practice Guidance No. 1 of 2025, underscoring our commitment to uplifting financial reporting standards in Singapore. This guidance highlights critical areas that directors should focus on to ensure robust financial statement reviews and compliance, amid global economic uncertainties caused by trade and tariff-related risks.

During the ISCA Conference, Ms Ng Meow Ling, ACRA's Technical Director (Inspection Department) also shared key observations from quality control inspections in the panel discussion with other audit practitioners.

Through issuing of guidance and sharing sessions, ACRA aims to support directors and audit professionals in upholding high standards of financial reporting.

ACRA's e-Newsletter for professional stakeholders

This e-newsletter is intended for general information only and should not be treated as a substitute for specific professional advice for any particular situation. While we endeavour to ensure the contents are correct to the best of our knowledge and belief at the time of writing, we do not warrant their accuracy or completeness nor accept any responsibility for any loss or damage arising from any reliance on them.

Copyright © 2025 Accounting and Corporate Regulatory Authority. All Rights Reserved.